EmiratesSetup is the perfect partner for business setup and company formation in Abu Dhabi and across the UAE. Starting a business isn’t easy but EmiratesSetup provides all the needed services for a hassle-free procedure and our specialists will accompany you during the entire process.

Companies that are planning to cooperate with ADNOC, the military or HQ, cannot ignore the fact that in order to be able to deal with the above mentioned entities it is vital to be located in Abu Dhabi and accordingly, to hold an Abu Dhabi Trade License.

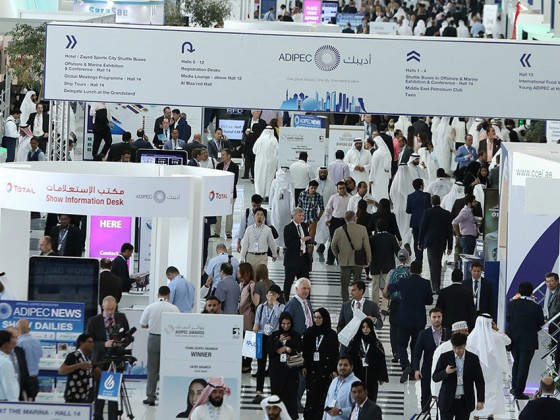

But not only these sectors are interesting for foreigners, Abu Dhabi is a fast-moving metropolis and has catapulted itself to one of the most popular destinations in the Middle East in recent years in regard to business opportunities as well as investemnt opportunities.

HIGH CHANCES OF SUCCESS

The local industry giants are constantly looking for new technologies, services and products. Also the retail or the area "food & beverage" as well as the need for luxury goods in general are to be considered.

Abu Dhabi is highly interesting for both start-ups and corporate offices and is an ideal business hub for the entire region.

100% TAX-FREE

Of course, just ike in Dubai, there are no income or corporate taxes in Abu Dhabi. The only tax is a 5% VAT, which was only recently introduced. It is a negligible run-through post and does not affect your company´s turnover.

There are currently 8 Freezones in Abu Dhabi to chose from. Each one is dedicated to a certain Industry or business sector.The most famous of those Freezones are definitely the Abu Dhabi Global Market Square (ADGM) in the heart of Abu Dhabi on Al Maryah Island and twofour54 Media Zone on the outskirts of the city.

Of course, depending on the location, the freezones also differ greatly in terms of running costs. The decision for the right Freezone is therefore an important cost factor in any case.

In principle, the guidelines and costs to setup a Mainland Company are almost the same as in the rest of the UAE. However, there are slight differences in setup timeframe, the initial start-up costs and also in the provisions for the license duration or the office space obligation.

Abu Dhabi came up with an unbeatable offer: For start-up companies the license is valid not only for one but for two years and the cost was reduced considerably. In addition, for many activities it is not mandatory for the first 2 years to rent an office. A private residential address will be accepted by authorities in order to process the trade license. Both of this exciting new regulations come as great relief to entrepreneurs as the risk of opening a new business is much lower and the cost saving is enormous. However it has proven a bit difficult to actually avail this offer and it is restricted to certain activities only.

NO SHARE CAPITAL REQUIRED

Another new regulation was the abolition of the share capital when establishing an LLC. But please note that for some activities such as the tourism industry it is still necessary to produce a share capital. Nevertheless, in any case, it is advisable to have a corresponding share capital.

LOCAL SPONSOR / PARTNER

Till the end of 2020 a so-called local sponsor was mandatory for the formation of a Mainland LLC. It is still in effect but the government has recently announced that for some activities (Commercial) a company can be 100% foreign owned.

The Local Sponsor is always the majority shareholder with at least 51% ownership of the company. This does not mean however that he is automatically entitled to 51% of the company's profits. He acts only as silent partner and there are various side agreement options to regulate this government stipulated business model to hand over the control of the company to you.